The Power of Money vs The State

Bitcoin is engineered, not decreed. The properties of Bitcoin closer match the nature of our industrial digital reality than the legalistic power structures of state-based money.

Paul Sheard is the Wall Street Journal best-selling author of The Power of Money: How Governments and Banks Create Money and Help us all Prosper. As a financial markets economist Paul has extensive experience including previous roles as Vice Chairman of S&P Global, Chief Economist of Lehman Brothers, and Senior Fellow at Harvard Kennedy School.

—

I met Paul at a talk at the Foreign Correspondents’ Club in Tokyo and we talked about Bitcoin and the global monetary system.

I interviewed Paul on the Transformation of Value Podcast:

Sheard’s book is a commentary on how contemporary central banking and money works, arguably in its current form since 1989 (with inflation targeting being pioneered by my very own Reserve Bank of New Zealand!).

Sheard does not write with the kind of imperative language and narratives that central banks use to shape sentiment and stir up the public perceptions of “inflation expectations” or “global shocks”. Instead he writes with monetary realism as he describes the way he sees the system actually working through the lens of Modern Monetary Theory.

When it comes to money the difference between “what is said” and “what it is” presents an interesting area for exploration. At a high level I wonder whether we can ever have a logical framework or model for understanding such a human innovation as money? Or at best can we only hope to have sufficiently sophisticated descriptors to map onto the unspeakable reality?

It seems to me that our descriptors are only able to nod at what is manifested and do not, and perhaps cannot, describe the exact mechanism or natural function that underpins the world of money and how people ascribe value.

Money, like language, has a physical form but its value does not exist in the physical plane. The word for “mother” in almost every language is tied to the structure of the vocal chords of a baby and our biological reality but in general there are no physical laws or functions that govern language. The sound for the word “money” does not mean anything in nature beyond a vibration through the air. The signified concept of money is present in physical notes and coins, or even bits on a hard drive, but they are merely the physical accounting mechanism for the abstract concept of value.

It is the human abstraction layer that intersects with the physical forms of language and money to create the hybrid system that shares the qualities of hard reality but also the imagination, plasticity, and the unbounded potential of the human mind.

Sheard acknowledges this by outlining that there is a real economy of factories and things, and a financial economy of numbers, and regulation and laws. Arguably it was the latter that led the way out of the grasslands and paved the way for humankind to organise and find itself an agrarian and later industrial species.

Co-ordination of physical reality via abstract human concepts such as money and language is a profound idea to wrestle with. I think it acknowledges more than just the power of money but the power of the word.

But what makes this so? It still seems as if all analysis of money systems (and language) must be post facto, that is, we have to observe before we can understand what has happened. It is impossible to predict what money is from an empty starting position or from a “desert island” because such situations simply don’t exist generally. It would be the same as trying to predict the ways in which the English language will change in the future or how a new language might emerge.

On an actual desert island with a group of shipwrecked people advanced concepts of money do not spontaneously emerge because life is likely stuck in a survival mode of either working together at the base layer of reality to secure food and shelter or otherwise fighting each other for those resources. In this sense, human law and natural law converge via the biological rules of the jungle and of pure physical force.

But this is not civilisation. Civilisation, it seems, has an inherent relationship with language and money, and the ability to organise and provide a division of labour. Money can only develop over the longer-term together with the language and culture of that civilisation in a kind of double helix of prosperity.

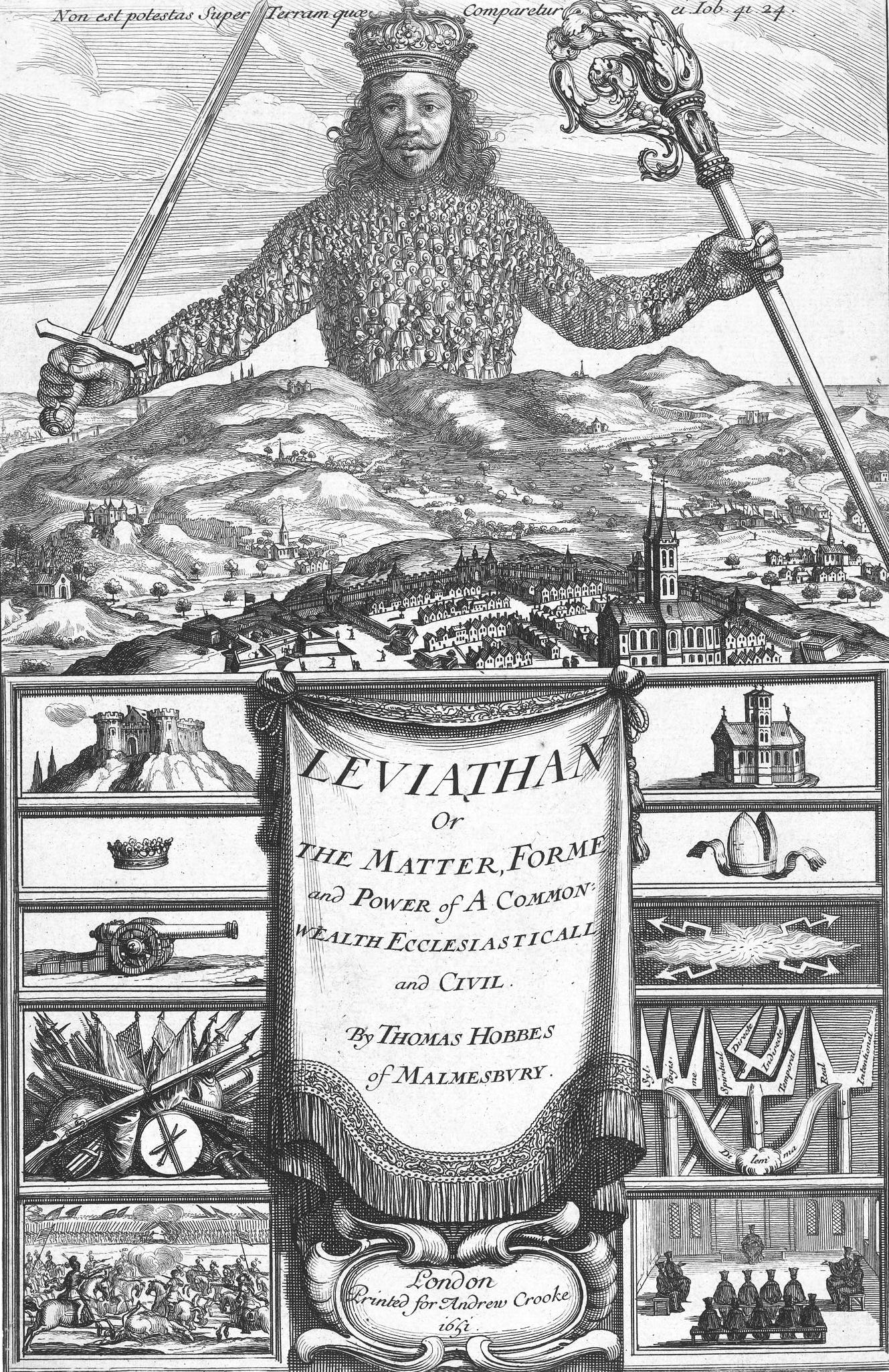

Thus we encounter a Hobbesian presupposition on the the way society forms and the relationship to the state as the arbiter of peace and law.

The social contract is essential.

The Leviathan (the State) must have absolute power to enforce laws and ensure peace and to facilitate the social contract.

But even though Leviathan has absolute power, its legitimacy comes from the consent of the governed.

This logic sees the leviathan in the form of the State as the beginning and the end of all things, mediated via consent from the governed. The locus of control of society sits firmly within the State, with its ability to manipulate reality fundamentally vested in its monopoly of violence but perhaps more importantly through the language of money. Though as we have seen the manipulation of the actual language and speech of society also comes into play sometimes (narrative shaping!).

The manipulation of money and language has the very real ability to change the world and rearrange our human reality yet these things themselves do not follow any physical natural law. There are no rules of nature or mathematical concept that defines the structure of a sentence or that there should be 100 cents in a dollar.

Central bankers, and I have met a few, would scoff at such lofty political critiques. They may enjoy the literature or history of such arguments, and they are often well-read and intelligent individuals but fundamentally their days are spent in the charts, in the policy, in regulatory frameworks and summits.

In my experience central bankers and politicians are cognisant of the power they have but they do not have the capability to clearly communicate what mechanism grants this power beyond circular logic. For the most part I see the institution of central banking as tending to the abstract machinery of the financial economy that oils (or sands) the gears of the real economy.

Price stability is one of the key tenants that central bankers set out to control but really is this again post-facto? They are not (usually) keeping prices stable in the strict sense of commanding what the prices should be, they are instead manipulating the denominator to make all prices appear stable.

Ultimately the consolidated state of government and central banking assumes (and increasingly so with financial surveillance) the central position in the equation of the economy. The state sits at the fulcrum of the wealth of nations, intermediating all relationships big and small.

Though the state may publicly deny such claims or point to legalistic separations of power we must acknowledge that clearly the consolidated government is the gatekeeper of the moat upon which the modern monetary theory of economy must operate.

The Language of Modern Monetary Theory

MMT is a descriptor for how money works that says “Governments spend money into existence, increasing the money supply in pursuit of a better society. They levy taxes to tap the brakes on inflation.”

Sheard discusses how Government debt is mislabeled and is not really an issue and instead represents a kind of running total on the amount of capital expenditure a state has made on our behalf. Additionally Sheard details the “Government as a household" fallacy in that the government does not have to balance the books and that no such constraint exists for the government.

In short: What is true for an individual is not true for society, and once again the State sees itself at the centre of society.

In the MMT model taxes serve the prima facie role of social cohesion (the rich should pay their fair share / we ought to redistribute money to the poor), but from a systems perspective taxes only exist for removing money from the system to reduce inflation and where they come from does not really matter. If the money printer* is the accelerator, taxation is the breaks.

*Sheard has nuanced critiques on the popular notion of “the money printer” which are valid but I use that term here as a shorthand here for the process of money coming into existence regardless of the mechanism.

There are of course the nuances of this performance, electoral politics, and the will to power which serve to limit the understanding of MMT becoming common knowledge. There needs to be someone to blame, there needs to be political heads that can roll, taxes to be cut or raised, but in sum it is deemed a useful myth for the population of a democratic nation state to believe that taxation is what is building the roads and the schools, that honest financial confession to the tax lords and personal austerity are virtuous and necessary.

The conspiracy of language and law

“In trying to understand fiscal policy debates, it is important to distinguish between two levels of analysis we might call the fundamental level and the institutional level. By “fundamental level” I mean how things work in principle or in the abstract; by “institutional level” I mean how things work in practice, in the real world, given the institutional rules (including laws and regulations) in place.”

(Sheard, 2023, p. 46)

MMT has at its centre the State and necessarily requires all things to somehow or rather connect to the State. Thus the money system described by MMT, whether more prosperous or less prosperous, is fundamentally not governed by any kind of physical law or mathematical reality, but instead a coveted and hidden set of laws set by political apparatchiks and technocrats. The Power of Money really describes the Power of the State by virtue of its monopoly on power to spend money into existence and set tax rates and enforce collection and acceptance of its scrip.

I find it ironic that that etymology of the word cryptocurrency, crypto, comes from the Greek word for shadows / hidden. Bitcoin is as clear as day with its open-source ledger whereas the legacy financial system is so cloistered and hidden that it is possible that no one really knows how it works.

But I do not want to make moral equivocations here, I share the simple opinion that “it is what it is”.

In short: MMT assumes that the rules of football are equivalent to the rules of gravity. It equates the rule-setting power of the State to the fundamental rules of nature. Because money is both a physical and abstract concept at the same time the difference between the rules of nature and the rules of the game rear their head from time to time in shocks and crises that require further intervention and more rules to correct the course.

The designer of the game can go beyond just being a referee and giving a yellow card or conferring a free kick, but can actually redesign the rules of the game mid-play. They can manage the expectation of the players and the crowd through their announcement of the rules and the changes which once set become the new “reality”.

In this model the State is the referee and scorekeeper at the centre of all financial relationships. The State is at the balance point between all transactions. This is an extreme position of power and though who wields this power changes periodically it has up until now not faced any real challenge fundamentally. The rules of the game and the rules of nature have been “joined at the hip”.

Bitcoin as Rule of Mathematics

Bitcoin is not some new kind of central banking or innovation to the words or language of the State, it is and was designed from the beginning to be a new game entirely.

As Parker Lewis has written, money is not a pure hallucination, it is about the monetary integrity of the system, and its properties.

I wonder if we can see in Bitcoin analogies to the social language example from earlier?

An industrial, digital society, requires mathematical precision, it requires programming languages that follow the rules of logic that underpin reality. We cannot return to less precise forms of manufacturing or knowledge transfer. The measurements can only become more refined and accurate.

Institutional human systems are created through law, and law is social language and imagination which are modes of inherent contradiction. Words are the site of both meaning-making and meaning-manipulation at the same time. The mandate of a central bank to keep inflation within an “acceptable level” is open for interpretation, ripe for being made a state of exception. The fact that it can even be changed indicates that it is not natural law, but human law.

But when we ask whether we can actually create or design new languages I am reminded of programming languages. New programming languages are regularly created and adopted, introducing more sophistication or accuracy and developing their own niche uses and network effects.

As an industrial species we may not be able to bootstrap social languages but we can bootstrap programming languages that can more accurately describe reality.

I appreciate that that the idea of reality manipulation and new kinds of authority may have partly inspired the development of the Ethereum Virtual Machine etc and the ideas around smart contracts as a way of intervening in worldly authority. To be clear I think Non-Bitcoin cryptocurrency projects are ultimately not viable as money over the long-term for other reasons, but conceptually something like Ethereum fails as a reality manipulation system because it lack the authority to act and “be” in the real world.

For a programming language (or a human language) to manipulate reality it needs some kind of access to reality and requires resources and power. Ethereum ultimately has no locus of control that can actually impact reality substantially. Ether cannot force anyone to do anything because the value and resources it seeks to manipulate with smart contracts either exist outside of the network or rely on the token within the network which is increasingly worthless.

Bitcoin has superior monetary properties and is able to manipulate the resources within the network over the long term and credibly enforce ownership and value transfer without the need for the peace-making / war-making dictum of the State.

These superior monetary properties can then flow on to impact actual reality and the allocation of physical resources. This is in contrast to the power of the State which is backed by its monopoly on violence and which can force you at gunpoint to dig a ditch.

Though Sheard gives his final chapter to talking to Bitcoin and cryptocurrency with some generic descriptions, he writes it off as not offering any significant threat to the Central Bank System.

I think this is primarily because he tries to see Bitcoin as it fits into the rules of the game, and not into the rules of nature. This is a conceptual category error. Bitcoin is not a nation-state currency, it does not suffer current account deficits. Bitcoin is not willed into existence the way that fiat money is but instead it is created through an entirely new mechanism, proof of work, requiring electricity to be spent and paid for.

I again do not ascribe and moral judgement to Shear’s miscategorisation of Bitcoin for just as he laments how the public and commentators are routinely wrong about the way money works insofar as their descriptors are less accurate, the descriptor of his models of MMT simply cannot understand anything outside of the eyes of the State e.g. Bitcoin.

Just as one must see the State before one can understand the State, naturally anything that exists outside of that lens of the State cannot be “seen” by the State either.

I think it is this realisation that eclipses the day-to-day political and fiscal considerations of central banks and government.

In this article I hope to highlight that I think fundamentally the MMT-school (and its critics!) make the mistake of assuming that their descriptors of money as it is today are equivalent to models for value “forever and ever”.

The true implications of the new game of money are starting to be realised by some. Though there is a possibility that the assumptions and axioms by which Bitcoin could become the global money may be somehow flawed, as indeed the assumptions of a universal “ether” were in the 1880s, I am of the opinion that there is a decent chance that Bitcoin does in fact change everything.

It is easy to point at Bitcoin’s integration with the legacy financial world, its inclusion in ETFs and corporate portfolios etc as evidence of its asset-like nature and State capture. But the bigger, and more visionary proposition is what if Bitcoin really is a new way of doing money? What if it is a new kind of synthesis between law and language, of the real economy and the financial economy?

Me and the other Bitcoiners who have studied this thing tirelessly for years have uncovered what we see as some insight or universal truth about the nature of money that was not appreciated before.

So what happens next?

Coming back to the social layer I think it is difficult for people outside of the Bitcoin world to grasp the intransigent nature of hardcore Bitcoiners. We have seen what this new Truth means and we have taken the “orange pill” so to speak. We have looked down that hallway of mirrors and seen the exit and many of us have spent much of our time thinking about and building on Bitcoin.

If we come back to a monetary realist perspective and assume that the best we can do is descriptors of the unspeakable reality of money then we see that Bitcoin is already doing what it set out to do: It is non-state money, enabling peer-to-peer electronic cash, and it’s here to stay.

Bitcoin is the first non-state money. Even the fabled gold in all historical cases required the sovereign to mint gold into specie with the face of the sovereign to anoint it as money proper and not simply a barter commodity. The State has always been required to judge, assay, and mediate transactions until Bitcoin.

Bitcoin is money, there is no doubt about it. Its volatility is often quoted as a limiting factor but by the classical definition of medium of exchange, unit of account, and store of value, it is money for at least some number of people.

It is true that most people measure their Bitcoins in fiat terms but that does not preclude the fact that it is money and is being used as money. When I spend Japanese yen for example I regularly equate it back to New Zealand Dollars in my mind.

In the same way many people spend Bitcoin and equate it back to fiat currencies. This is not just a “counter-trade” but a kind of practical synthesis of currencies and exchange rates.

At the very least actual Bitcoin is required to be spent in the form of transaction fees to actually use the network, indicating that it has Unit of Account and Medium of Exchange qualities already in these dimensions.

MMT vs BMT

I may be wrong about all of this but as scholars and students of history we must seek to understand what is actually going on and be rigorous in our investigations.

What is Bitcoin Monetary Theory (BMT)?

Bitcoin is fundamentally a new kind of money that is different from state money. Bitcoin is engineered, not decreed. The properties of Bitcoin closer match the nature of our industrial digital reality than the legalistic power structures of state-based money.

I think that Bitcoin is in fact a better kind of money in a moral sense as well as an engineering sense.

I can only guess that the State is unable to “see” Bitcoin just as most people struggle to “see” the State. Though Bitcoin is held by governments and corporations around the world as an asset, similar to gold bullion, it does not and cannot actually exist in any nation state’s monetary balance sheet because there is no corresponding central bank liability associated with it. When it comes to Bitcoin, the fulcrum of value does not hinge on the extended middle finger of the State.

This is the first time that has ever happened.

Politics is downstream of technology

Bitcoin is a new thing and it is disruptive to the way we think reality works.

As intellectually rigorous thinkers we must recognise the nature of change. Everything is subject to change, degradation, innovation, disruption. More so, we have to assume that since the monetary order has changed before and that its laws are not universal laws, then it must have the capability to change again.

I believe that as the machinery of central bank money starts to break down for a myriad of reasons the monetary black hole of Bitcoin will accrete more and more value.

The technical mechanism of MMT will start to unwind and will require its own “new logic of being” just as 1989 and inflation targeting, and then QE, and so forth augmented the secular liturgy of Statism.

Though the real economy may still exist under the physical dominion of the State for now, the new money of Bitcoin does not. Yes, the dollar fiat system has inertia and power and a whole lot of history behind it. But the world is fragmenting geopolitically and even central bankers and politicians will soon realise this.

Even if individuals within the State begin to become cognisant, there is still a path dependence to the institutional monetary responses that must serve the logic of the game. They must continue to perform their monetary policy rain dance to keep the whole thing going.

But the lifeboat now exists: Bitcoin.

– Cody Ellingham

—

P.S. Come for a walk with me in Kamakura

There is a lot for us to talk about. There is so much to do. Are you in Japan and looking for a special walking experience that is only one hour from Tokyo? Let's Take a walk together sometime.

Book now:

https://kamakurawalks.com/